States’ tax websites and sales tax searches

TaxConnex

OCTOBER 8, 2024

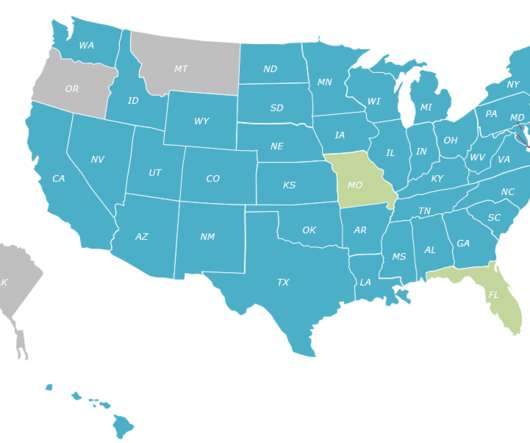

But not all search engines – or state tax websites – are created equal. What it’s like typing “sales tax” into that little rectangle with the magnifying glass on each state’s website? Here are first impressions from one-and-done searches for “sales tax” on the revenue site of each state. Connecticut Dept.

Let's personalize your content